Creating wealth is an art. It requires patience and discipline, and can only be attained by skilful handling of one's resources. It does not matter how small an amount you can set aside to start investing. What matters is...

4 things that every home loan borrower must know

Your dream home is an outcome of months or years of planning. From choosing the right property to making deals and clearing legal hurdles, organizing a master plan for your home...

India happens to have the highest number of road deaths in the world. As a matter of fact, India alone is responsible for 10 percent of road mishaps that take place globally. So what do you understand from these...

All of us are constantly working towards well-defined financial goals. When you have a financial plan in place, you can easily fill the gap between what you have and what you want. A financial plan will lay out the...

The importance and need of buying car insurance is not unheard of. Car insurance policy offers various benefits and assistance to the policyholders during any peril. It is recommended for the first-time insurance buyers to not believe in everything...

How to Create Viral Instagram Photos

There's an ongoing myth or misconception when it comes to social media marketing. I can understand where this myth is coming from. There are all sorts of companies, organizations, and individuals out there who...

What Is the Process of Calculating Interest on Fixed Deposits?

Investing in a fixed deposit (FD) is one of the safest ways to build your fortune. However, before you put your hard-earned money into the account, you must learn how...

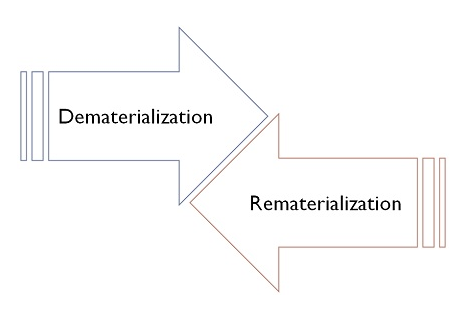

Anyone who is even remotely involved with trading and share market has at least once heard the term “Demat Account”. A Demat account allows an investor to invest and then store their shares in an electronic form. Having a...

Life Insurance Premium Payment Options

A life insurance plan is a contract between the policyholder and an insurance company. With regular premium payment, you get life coverage. If you have a life insurance policy, you need to be aware of...

ELSS vs Fixed Deposit - Which is the Best Tax Saving Option in 2020?

fixed deposit, fixed deposit returns, fd interest rates

As the tax-season commences, you may be scrambling through different ways to make tax-savings. While there are numerous ways...

What are the Different Types of Mutual Funds in India?

Most of us have heard about mutual funds but do not exactly understand the whole concept of it. Well, mutual funds are an investment tool which helps pooling funds from...

Using Tax Benefits of Life Insurance in Your Financial Plan

When you buy a life insurance policy, you get tax benefits which reduces your taxable income. This advantage makes insurance a lucrative investment for the long-term. But are you aware...

JD logistics Drives China Logistics Ecosystem Development

Would you want to discover one of the best ecommerce platforms across the world? Among the world's great e-commerce platforms, JD Company is at the lead line. The company works in close association...

Repercussions of Not Having a Third-Party Car Insurance Cover

Taking your car out for a ride with your loved ones is fun and games until you bump into someone else’s vehicle and end up in an accident. Buying a car...

Exchange Traded Funds (ETFs) are similar to mutual funds with one key difference – ETFs are listed on the stock exchange just like equity shares and can be bought and sold on the stock exchange during trading hours in...