Anyone who is even remotely involved with trading and share market has at least once heard the term “Demat Account”. A Demat account allows an investor to invest and then store their shares in an electronic form. Having a Demat account comes in very handy since most of the transactions are conducted online these days and an investor can trade conveniently with a Demat account. Apart from the shares, a Demat account also holds bonds, ETFs, mutual funds, gold bonds, and other similar assets with a unique ISIN number.

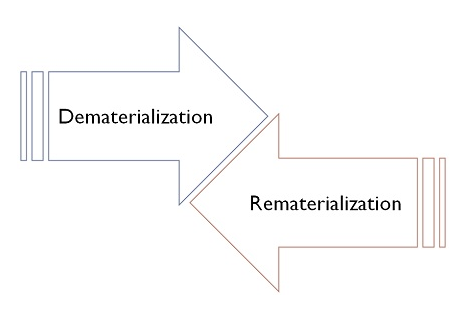

When you come across the word Demat account, there are two more terms that you often hear along with it: Dematerialisation and Rematerialisation. This article helps you understand the comparison between Dematerialisation and Rematerialisation. To understand the difference between the two, you must first understand the definition of these terms.

What is Dematerialisation?

Dematerialisation can be explained as a process in which, at the investor’s request a company recalls the share certificates in paper form from the investor and an equivalent amount of electronic securities are credited to their trading account. Shares in dematerialized form don’t comprise of the typical number. Besides, the shares are similar and exchangeable.

The investor must open a Demat account with the Depository Participant in order to request dematerialization. Only then the shares will be deposited to the account in an electronic format. Dematerialisation is not mandatory, the investor is permitted to save securities in physical form. But when the time comes to sell the securities in the stock exchange, they need to be dematerialized. Also, while buying shares they get them in an electronic format.

What is Rematerialisation?

Rematerialisation can be defined as the process in which, the shares in an electronic format in a Demat account are converted into traditional share certificates. If a person has already converted his securities into electronic format, he has the choice of moving them to physical form again. For this purpose, you are required to fill a Remat Request Form (RRF), and yield it to the Depository Participant (DP), with whom you have a Demat account. People at times opt for rematerialisation to dodge giving the maintenance charge of a Demat account that has only a few shares. The rematerialisation of securities can be done whenever desired. But, the securities that have been rematerialised cannot be traded in the stock market.

The Key Points Of Differences Between Dematerialization And Rematerialisation Are As Follows:

The method of transformation of shares from physical form to an equal amount of shares in electronic form is known as Dematerialisation. Whereas, the process where shares in electronic format are converted to electronic format is known as Rematerialisation.

Dematerialised shares have no independent identity and hence have no distinctive number. Whereas, rematerialised shares possess a distinctive number.

Dematerialisation leads to effortless and paperless trading. Your account can be accessed at any time and place. On the other hand, rematerialisation comprises of physical trading which may be very time consuming.

In the case of dematerialisation, the account is handled by the Depository participant. And in the case of rematerialisation, the account is handled by the company.

Procedure for Dematerialisation:

Open an account with a Depository Participant.

Fill in the DRF (Dematerialisation Request Form) and submit the form along with the share certificates.

The DP passes the request and the share certificates to the depository, registrars and transfer agents.

Upon verification, the investor’s account gets credited with shares.

Electronic transfer of shares can take roughly 30 days.

Procedure for Rematerialisation:

The investor has to submit the RRF (Remat Request Form) to the DP.

The form is then sent by the DP to the registrar.

New certificates are printed by the registrar and given to the investor.

Once the Remat request is confirmed by the registrar, the investor receives the new certificates.

The process of rematerialisation may take up to 30 days.

The processes of Dematerialisation and Rematerialisation are diametric opposites of each other. To explain it in a simple way, rematerialisation reverses the results of dematerialisation.