Creating wealth is an art. It requires patience and discipline, and can only be attained by skilful handling of one's resources. It does not...

India happens to have the highest number of road deaths in the world. As a matter of fact, India alone is responsible for 10...

4 things that every home loan borrower must know

Your dream home is an outcome of months or years of planning. From choosing the right...

The importance and need of buying car insurance is not unheard of. Car insurance policy offers various benefits and assistance to the policyholders during...

What Is the Process of Calculating Interest on Fixed Deposits?

Investing in a fixed deposit (FD) is one of the safest ways to build your...

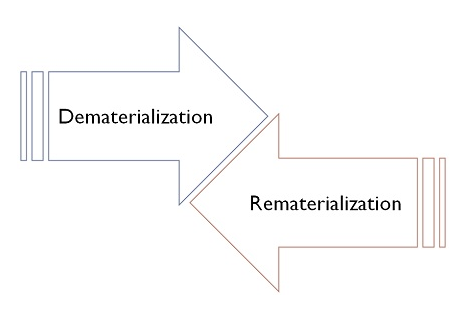

Anyone who is even remotely involved with trading and share market has at least once heard the term “Demat Account”. A Demat account allows...

How to Create Viral Instagram Photos

There's an ongoing myth or misconception when it comes to social media marketing. I can understand where this myth...

All of us are constantly working towards well-defined financial goals. When you have a financial plan in place, you can easily fill the gap...

A Salesforce call center is a customer service center that is powered by Salesforce CRM and integrated with Bright Pattern. Salesforce call centers provide a single...

Throughout human history, education has grown and changed. Since the virus's breakout, there has been a steady trend away from conventional schools and toward...

What are the Different Types of Mutual Funds in India?

Most of us have heard about mutual funds but do not exactly understand the whole...

Unit Linked Insurance Plan enables policyholders to get market returns along with insurance cover. A ULIP Insurance provides an investor with different types of...

Life Insurance Premium Payment Options

A life insurance plan is a contract between the policyholder and an insurance company. With regular premium payment, you get...

Using Tax Benefits of Life Insurance in Your Financial Plan

When you buy a life insurance policy, you get tax benefits which reduces your taxable...

ELSS vs Fixed Deposit - Which is the Best Tax Saving Option in 2020?

fixed deposit, fixed deposit returns, fd interest rates

As the tax-season commences,...